Stock Alert: the UK “Green” Boom

ALERT 11th March 2021 |

Almost four years ago I decided to buy “legal weed” right here in the UK.

At 3:05 on Wednesday 29 March 2017 I clicked the “order” button and my purchase was confirmed and on its way.

For me it was a revelation. The ease at which I could do this was a breath of fresh air. It was also a signal to me that Britain was on the threshold of a new era – and what I expected would evolve into a huge investment opportunity.

It has taken four years to see that revelation come to fruition.

Right now, Britain is standing on the cusp of an explosion of an industry that could drive growth and push the prices of a select number of UK-listed stocks higher.

The legalisation of cannabis and cannabis products in the UK is set to become one of the most exciting growth stories for the 2020s. Now, there is an easy way for investors to get a piece of the action – it’s time to ride the UK “Green” Boom.

From stigma to solution

Researchers are discovering new benefits of cannabis every year.

Research is showing it has clinical benefits for many ailments – ranging from arthritis and fibromyalgia to cancer. In many areas, this research is still early stage. But it’s leading to a surge in the world’s awareness of cannabis and cannabis-related therapies.

In my view, this could be one of the most exciting developments in biotech in decades. And, when you start to view cannabis companies as biotech, then you start to see this opportunity for what it really is.

The rise in awareness has helped cannabis stocks to boom on markets around the world. For too long those booming opportunities have been on foreign stock markets – such as the US, Canada and (more recently) Australia.

Now it’s the UK’s turn.

The listed cannabis companies will be the “founders” of the “legal weed” trade in the UK. And they could deliver life-changing returns to shareholders right here on the UK market.

Now as mentioned above, I’ve already joined this boom. I bought some “legal weed”. Now before you think the police are going to kick down my door, remember this: it was and is 100% legal.

To be totally accurate I bought a CBD vaporiser “vape” pen. I also bought three CBD canisters. The device I have is called the “Medipen”. At the time, it was a really novel way to access cannabis.

However, there’s an important caveat here. These cannabis vapes had no THC content at all.

So, what’s THC?

THC is tetrahydrocannabinol. It is the mind-altering aspect of cannabis. The “cannabis” I bought was CBD (cannabidiol) based oil mixed with pharmaceutical grade coconut oil.

That makes it 100% legal. Further, it’s completely safe as CBD doesn’t alter the brain in the way THC does. In fact, CBD has been shown to have a great number of therapeutic benefits.

William Norcutt is a pain specialist at James Paget University Hospitals in Great Yarmouth, UK. Speaking to New Scientist in 2015 about CBD, he explained it is unlikely to do any harm. In his own words, “the only way you could kill someone is by dropping it on their head.”

However, cannabis is an emotive word which still evokes a lot of concern among investors. That is unfair and wrong.

Proof that cannabis is a medical revolution

What a lot of people don’t understand is that human biology is built to respond to cannabis.

The human endocannabinoid system is connected to the central nervous system. It’s understood that the endocannabinoid system helps regulate physiological and cognitive processes such as:

- Fertility

- Pregnancy

- Pre- and post-natal development

- Appetite

- Pain sensation

- Mood

It’s this endocannabinoid system (that we all have) which scientists believe medicinal cannabis can influence. They believe the use of certain strains of cannabis can treat and maybe cure illnesses and disease.

Some of the research and development (R&D) findings about cannabis are astonishing.

Research from the World Health Organisation (WHO) in 2018 concluded,

- Clinical trials have shown cannabis to be an effective analgesic for chronic pain. The results indicated that vaping cannabis reduced neuropathic pain and pain associated with diabetic peripheral neuropathy.

- Cannabis oil containing THC can be beneficial for patients suffering from dementia, motor neuron disease, and neurogenic issues such as bladder control problems and muscle spasms.

- Considerable evidence suggest that cannabis and specific cannabinoids are effective at relieving nausea and vomiting due to chemotherapy.

And we know there are companies like Canada’s Canopy Growth that are supporting clinical research into the impact of CBD and cannabis in people.

Last year the company released research into the long-term effects of CBD. It found that:

CBD did not demonstrate any degree of acute or life-long toxicity or related liabilities at physiological concentrations. Instead, CBD extended mean lifespan up to 18% and increased late-stage life activity by up to 206% compared to the untreated controls within the study.

This is the first long-term study of its kind and supports the continued R&D into cannabis-related therapies. Now it’s worth saying, this study was on worms that share 60% to 80% of their genes with humans and have a lifespan of 2-3 weeks. Still, it’s the kind of research that a burgeoning industry needs in order to grow and thrive.

In my four-plus years of research into this area, I have come to the view that the use of cannabis as medical therapy for a huge range of conditions will be very widespread by the end of the 2020s.

The UK “Green” Boom starts here

Canada is widely considered the pioneer in the legalisation of cannabis both medically and recreationally in the Western world.

A highlight came in 2018, with the granting of Royal Assent to Bill C-45 in June. The new law legalised the recreational use of cannabis across the nation.

Meanwhile, in the US, California’s Proposition 64 from 2016 allowed the recreational use of cannabis in the state. Many states have since followed suit. Cannabis use is still illegal based on federal laws. However, in states like Nevada, Alaska, Colorado, Maine, Michigan, Massachusetts, Oregon, Vermont, Washington and, of course, California, it is perfectly legal to use cannabis. For medicinal and recreational purposes.

I expect that, over time, federal law will be amended to recognise the new reality.

Canada and many of these US states have had a thriving legal medical cannabis industry prior to the addition of a thriving legal recreational market.

But it’s the “Canada Model” – which went from medicinal use and acceptance through to the legalisation of recreational use at such a rapid pace – that’s so fascinating.

Looking at the Canada Model, we believe an equivalent boom is set to explode here in the UK. We are now starting to see cannabis-based companies list on the UK market and roll out of medicinal products. There is the real possibility that they will move into recreational products in due course.

In 2016 the Australian government – which is generally more conservative in relation to social matters than its peers in other Western countries – amended the Narcotics Act. This move opened the doors to a burgeoning legal medicinal cannabis industry almost overnight.

I’ve seen first-hand the explosion of the Australian cannabis industry over the last four years or so. It has provided all players with a bumpy ride but, for many, a profitable one.

Now, I forecast that a similar market explosion is about to take place here in the UK. It’s still an early stage for UK-listed companies, and there aren’t many of them.

The UK “Green” Boom is about to begin.

The numbers are huge

In 2019 the European cannabis market was estimated to be worth around US$3.5 billion. By 2027, that’s expected to grow ten-fold to almost US$37 billion.

What a lot of people don’t realise is that the UK has long been one of the world’s largest producers and exporters of legalised cannabis for medicinal and research purposes. Up to now, there have really not been UK-listed opportunities for investors.

The interesting stocks have all been listed on hard-to-reach overseas markets.

But that’s all changing. And it started with an innocuous government announcement just over two years ago.

It was in October 2018 when the Home Office unveiled very discreetly on its website that from 1 November 2018,

For the first time in the UK, expert doctors have been given the option to legally issue prescriptions for cannabis-based medicines when they agree that their patients could benefit from this treatment.

The law change, laid in Parliament today, came after the Home Secretary, Sajid Javid, listened to concerns from parents of children with conditions such as severe epilepsy.

The UK is now following Canada, the US and Australia into a legal medicinal cannabis market.

The social tide has turned. The legal tide is turning. R&D is identifying new therapeutic possibilities involving cannabis.

Stocks have been appearing on markets around the world and delivering huge gains for investors. I expect the exact same thing to happen here in the UK.

Introducing your latest Frontier Tech Investor recommendation…

Kanabo Group Plc (LSE:KNB) is a research and development company with a focus on CBD products for the retail wellness market.

However, it’s its longer term plan to develop its medicinal cannabis products which is where I see the big potential for the company.

And thanks to a set of recent announcements, Kanabo is well placed to take the UK and European markets by storm.

Kanabo is originally an Israeli company founded by CEO Avihu Tamir, who has experience with the Israeli market for legal cannabis therapies.

Israel was “the first country to allow medical and scientific research of Cannabis, and the first country to establish a national medical Cannabis program for patients.”

The first product that Kanabo focused on was a medicinal cannabis vaporiser and the company continues to develop medical grade devices for non-smoking consumption of medicinal cannabis.

Kanabo is already selling products in Europe.

Speaking about the opportunity of the UK and European market, Tamir said recently,

“There is going to be a swift change in Europe. I think that what we saw starting in the US and Canada around like five years ago is now reaching Europe…

“Once you have the public market in a certain country being opened, you suddenly see the shift in how the cannabis industry is being perceived by decision-makers.”

This is exactly what I see playing out here in the UK.

Kanabo’s primary product is the VapePod. Somewhat similar to the CBD vape I bought years ago, it’s designed to administer cannabis solutions through vaporisation.

VapePod has already received approval as a medical device for cannabis extracts in Israel.

You can also buy the device here in the UK through the Cannacares website. You can also get different CBD formulations, ranging from “Reload” to help clarity and focus, to “Repair”, which is designed to help with tension release and achieving balance.

These formulations are all CBD based, and have no THC content. A VapePod and single cannister of formulation costs £80. Single pod refills cost £40. Alternatively, the VapePod device on its own costs £50.

However, as mentioned, Kanabo is also developing THC formulations for more medicinally prescribed applications.

These THC formulations are to be used on patients with sleep disorders, chronic pain such as fibromyalgia and arthritis, and anxiety disorders such as post-traumatic stress disorder (PTSD) and obsessive-compulsive disorder (OCD).

Having used a CBD vape before, I’m keen to try this one out and will be getting one to test out with some of their CBD formulas. I’ll let you know in the coming weeks how that goes!

This development in medicinal cannabis is what I think holds the real long-term potential for Kanabo.

This was affirmed this week with an announcement (annoyingly before we got this recommendation to you) that Kanabo has struck a deal with PharmaCann Polska, a Polish subsidiary of PHCANN International.

The deal will see PharmaCann supply cartridges containing Kanabo’s medicinal cannabis formulas for its VapePod devices. This is important for Kanabo to build its European supply chain.

This deal helps to supplement the retail CBD wellness business and helps to take the VapePod device to potentially a growing market in Europe.

This new deal is off the back of a UK medicinal cannabis distribution agreement that Kanabo struck with Astral Health Limited – a fully owned subsidiary of LYPHE Group. According to the announcement, LYPHE Group is, “one of the main players in the embryonic but fast-developing medicinal cannabis market in the UK.”

Kanabo’s VapePod medicinal cannabis formula will be available to patients in LYPHE’s networks.

CEO of LYPHE Group, Dean Friday, said,

“We have seen the headlines, and we have witnessed the negative impact of opioids. Pain is not going to go away, so a more natural and caring approach to treating it must find centre stage. Thanks to our partnership with Kanabo we now have a metered dose product that can treat patients across the UK that suffer from chronic pain.”

These two deals recently struck by Kanabo are an indication of what I expect to see more of this year. I expect to see more deals, more agreements on the supply of medicinal cannabis and a fast-growing company take the UK market by storm.

There’s a lot of growth and potential upside here. Being an early-stage company, it’s hard to forecast exactly how much upside there is.

The main reason for that is the company hasn’t yet established itself sufficiently to make such forecasts.

Kanabo’s market valuation reflects how investors and observers perceive the growth opportunities. There are also many risks to consider.

Financials and risks to consider

The company has only just listed on the UK market. In doing so it conducted a fundraising bringing in gross proceeds of £6 million – which it aims to use in the next 12 months for sales and marketing, plus R&D.

Kanabo arrived in the UK market via a reverse takeover of Spinnaker Opportunities Plc – a cash shell company that was actively seeking opportunities such as Kanabo.

The actual process of listing was a couple of years in the making, with Spinnaker aiming to target cannabis companies from as early as 2018. Then, in December 2019, Spinnaker announced its intention to become involved with Kanabo. The transaction would in effect be a reverse takeover and the resulting company would be Kanabo.

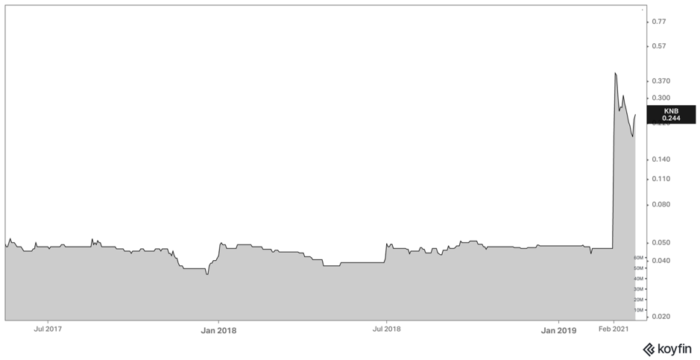

Then, during 2020, there were complications that set the listing back. Kanabo finally began trading on the London Stock Exchange on 16 February 2021 with an early market capitalisation of £23.4 million.

Since then the stock has been highly volatile. In early trading the stock surged to a high of GBX 51, which gave Kanabo a market capitalisation well in excess of £100 million.

Since then, however, the stock has found what I would describe as a more reasonable level for entry.

There’s no doubt the stock is a “hot stock”. And the cannabis opportunity is significant. Kanabo is also an early mover in its field.

Taking aside the volatility, the company is primed to move on big news announcements. This is precisely what it did this week after the medical cannabis production announcement noted earlier.

The stock soared by 24% on Tuesday 9 February. The timing unfortunate for us, but it reaffirms my view that, even with the stock having already seen a substantial rise from its listing, there’s still plenty of upside to this company.

And with a current market cap of £90 million, I think it’s got all the potential to see triple-figure gains in the short term.

Those returns are not without considerable risks.

For instance, certain restrictions imposed in the UK over the last 12 months have had a dramatic and negative impact on retail market sales. Kanabo’s existing business cannot avoid this impact.

Furthermore, government laws, regulations and restrictions on retail CBD products and medicinal grade THC cannabis products may change in the future in ways that would restrict the business of the company.

But there may also be further negative moves against the industry. These kinds of policy risks are serious and need to be considered with an investment like Kanabo.

Even ill-informed or partisan comment about potential (as opposed to actual) anti-cannabis regulation could cause a lot of damage to the stock price and, indeed, the company’s very existence.

Due to the company being relatively new, it has not yet made significant revenues in the retail market.

In fact, the most recent available financials to the end of 31 December 2019 indicate no substantial revenues, and currently £3.1 million retained losses. For the six months to 30 June 2020, the company had just £14,000 in revenues.

For now, Kanabo is reliant on retail CBD sales to grow the company and to expand and achieve its desired longer term strategy.

The company even acknowledges,

If interest in Retail CBD Products should diminish or fail to grow as anticipated this could mean that the Enlarged Group is unable to generate sufficient revenues from the sale of its Retail CBD Products to be able to execute its short term and future strategy.

It’s a company where there’s a very good chance that future capital raisings will be called upon down the track to either bolster the balance sheet or to assist in the general expansion and growth.

Such capital raisings can dilute holdings, where there isn’t an offer to retail investors. This is something to be aware of – and it can have an adverse impact on the value of your holdings.

What we will keep an eye on is Kanabo’s progress in generating revenues. Absence of meaningful revenues will likely have an adverse impact on perceptions of the stock and may present a lower price for investors.

The bottom line is that this is a high- risk punt on an exciting business that should do very well from the UK “Green” Boom.

Action to take

Kanabo Group Plc (LSE:KNB) trades on the London Stock Exchange with a current price of GBX 25.14 and a market capitalisation of £90 million.

Volume in the stock is around 6 million per day which makes it liquid and relatively easy to get into.

However, Kanabo is volatile, and high risk, so only invest money you are prepared to lose completely.

It has already seen a peak as high as GBX 51 and just this week had traded near GBX 17. Expect more volatility in the short term.

For that reason, and given our long-term view of the stock, I’m not recommending a stop/loss on this one.

What I want to avoid is being stopped out of the position because of short-term excessive volatility, and then missing out on a strong rise.

I reiterate that this is a very high-risk stock and that you should treat it as such.

Action to take: BUY Kanabo Group Plc (LSE:KNB) current price GBX 25.14. Buy up to GBX 28. If the stock trade above the buy limit, do not buy and wait for a suitable entry point at or below our buy limit.

Name: Kanabo Group Plc

Ticker: KNB.L

Price as of 11.03.21: 25.14 GBp

Market cap: £90.56 million

52 week high/low: 51p/0.05p

Buy up to: 28p

Regards,

Sam Volkering

Editor, Frontier Tech Investor