The cheapest, easiest and safest way to buy bitcoin in the UK

30th March 2020|

In this guide I’ll show you the easiest, safest and cheapest ways to buy bitcoin, Ethereum and other cryptos in the UK.

[Please note this post uses affiliate links. If you want to know what that means, or find out why I use affiliate links, you can take a look at my disclaimer page.

Southbank Investment Research does not gain a commission from any of the referrals in this article.]

For this week, I’m just going to pretend like the whole coronapocalypse isn’t happening.

I’m sure by now, you’re probably sick of hearing about it, and sick of living in lockdown.

So, instead, let’s take a look at another topic: buying bitcoin and other cryptos.

As I said in the last couple of articles, right now could be an extremely good buying opportunity – so long as you follow the three golden rules of crypto investing I lay out further on in this guide.

And in any case, it’s kind of strange having a service dedicated to crypto without any information on how to buy it.

I’ve also not seen a single article or website that shows the cheapest place to buy bitcoin in the UK.

Many recommend services that have high fees and bad exchange rates. And many of the articles recommending them are pretty out of date.

I intend to keep this guide updated and add to it on a reasonably regular basis.

Eventually I will add screenshots of exactly how to use these services, but for now I’ll just get the basics down.

It’s probably also worth noting I’ve personally used all the services in this guide and never had a problem with them.

I would never recommend a service I hadn’t personally used and had a good experience with.

This is, by far, the cheapest way to buy bitcoin and Ethereum in the UK

If you’re used to using exchanges, then Binance Jersey is by far the cheapest way to buy bitcoin and Ethereum in the UK.

And to cash out of it, too.

Unlike many exchanges, it is based in the UK – in Jersey – and uses British pounds as its default currency.

So, to start with, you’re not incurring any fiat currency exchange fees when you want to deposit or withdraw cash.

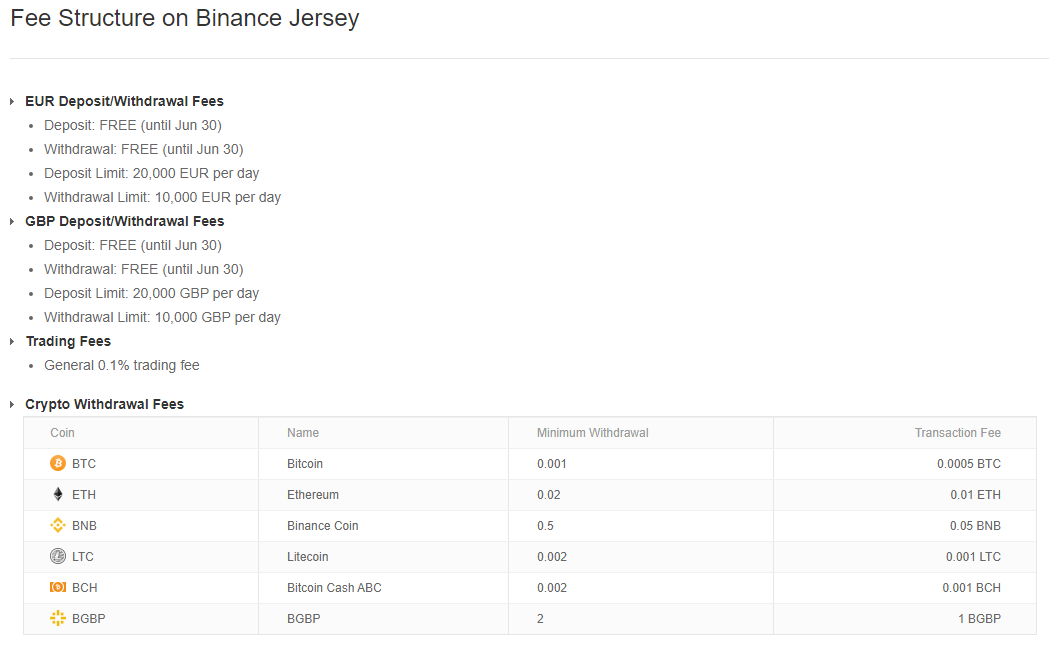

It also has zero fees for depositing and withdrawing cash, and only a 0.1% trading fee.

Here’s a screenshot of its current fee structure (accurate as of 27/03/2020).

Another reason Binance Jersey works out so cheap is because you are buying at the market rate.

You are buying from and selling to other buyers and sellers. So the rate you are buying and selling at is literally the current market rate.

There are no hidden mark-ups or deductions – save for the 0.1% fee Binance takes.

Other services, like Bittylicious and Coinbase for example, give you much worse rates because they are taking big fees behind the scenes.

Coinbase, for example charges 1.49% fees on every buy/sell… and 3.99% if you use a credit or debit card to make the buy.

With Binance Jersey, you can see the full order book when you trade, so you can make sure you’re paying or getting the going rate.

And the 0.1% fee is almost 15 times lower than Coinbase’s 1.49% fee.

However, that’s not to say Coinbase should be overlooked, as I’ll show you in just a second.

There are two things to be aware of if you decide to buy and sell using Binance Jersey.

- there are only a very limited selection of cryptos to trade: bitcoin, Ethereum, Litecoin, Bitcoin Cash, Binance Coin and a GBP-based stablecoin.

- The daily volume isn’t super high. So if you are trading a large amount, you could end up running through the order book and paying more than you would with a larger service like Coinbase.

As long as you are aware of those two caveats, Binance Jersey is by far the cheapest way to buy and sell bitcoin in the UK.

Start trading on Binance Jersey.

This is the safest and easiest way to buy bitcoin in the UK

Sometimes, the simplest way is the best.

And while, Coinbase certainly isn’t the cheapest way to buy bitcoin in the UK, it’s certainly the easiest. And the safest.

Until I started using Binance Jersey as a fiat on/off ramp, I pretty much stuck with Coinbase.

Sure, it may not be the cheapest. But, 1.49% fees aren’t really that bad when you transfer your money in/out directly from a bank account.

I would definitely avoid buying with a credit or debit card though. While a 1.49% fee is acceptable for Coinbase’s level of security and accountability, 3.99% is plain ridiculous.

Coinbase also has huge liquidity and a pretty good number of cryptos available to trade now.

In the UK you can buy and sell:

Bitcoin, Ethereum, Ripple, Bitcoin Cash, Litecoin, EOS, Tezos, Stellar Lumens, Chainlink, Ethereum Classic, Cosmos, Basic Attention Token, Augur, 0x, Kyber Network, Dai and Orchid.

Plus, Coinbase is also insured, and pretty much the most trusted exchange in the world.

So, in theory at least, if it were to suffer a massive hack, your money would be safe. However, I wouldn’t like to test that theory.

Of all the crypto exchanges, Coinbase is the one that works most like a regular financial institution, which you may love or hate, depending on your outlook.

But its main selling point is its simplicity.

It has a great app that “just works”. And the website is super straightforward, too.

If you are not tech savvy, or if someone who isn’t tech savvy is asking you how to buy bitcoin, then Coinbase is definitely the service to use.

Like I said, for many people the simplicity and security outweigh the extra fees.

However, the main caveat with Coinbase is the delay.

In 2019, Coinbase started forcing you to wait five days after you deposit money before you can move it.

You can deposit money and buy bitcoin the same day, but you can’t then move that bitcoin for another five days.

And you can’t transfer your deposited money to Coinbase Pro for five days either.

Using Coinbase Pro can be a good way to pay lower fees than regular Coinbase.

But, it’s still more expensive than Binance Jersey, and when you try fund your Coinbase account, you need to wait five days before you can transfer it to Coinbase Pro and then trade.

So, if you simply want the cheapest and fastest way of buying and selling bitcoin or Ethereum, I’d use Binance Jersey rather than Coinbase Pro.

But if you don’t mind not being able to move your money or crypto for five days, and you don’t mind the 1.49% fees, then regular Coinbase is a winner.

Plus, if you register for Coinbase using this link, we’ll both get £8 when you trade over £80 worth of crypto.

See, in the world of crypto, everyone can be a winner.

But let’s not get too hung up on Coinbase, because there is one more exchange that offers the ease and security of Coinbase with the speedier trading of Binance Jersey.

And that exchange is Bitpanda.

This is the safest, fastest AND easiest way to buy bitcoin – and a number of other cryptos – in the UK

If you’re a fan of overused analogies, you can think of Bitpanda as being the “Goldilocks” of crypto exchanges.

It doesn’t have a holding period like Coinbase, is much easier to use then Binance Jersey, has a great reputation, a powerful app and renowned security… and it has a very good selection of cryptos to trade.

So if you’re looking for an exchange that ticks all the right boxes, Bitpanda is probably the closest you’re going to get. For now, at least.

And as an added bonus, it is also based in Europe (Vienna), which means it is much more highly regulated than most exchanges.

I would probably only put Coinbase above it in terms of security and legitimacy.

The fees on Bitpanda, are pretty much the same as Coinbase: 1.49%.

But, unlike Coinbase, you can move your money and crypto around as soon as you deposit. There is no forced five-day holding period.

And, if you’re au fait with crypto trading on more complex exchanges, you can also use Bitpanda Pro, which like Coinbase Pro has much lower fees.

The fees on Bitpanda Pro are 0.1% for makers and 0.15% for takers – so almost as low as Binance Jersey, but with a bigger selection of cryptos.

Here are all the cryptos you can buy and sell on Bitpanda:

Bitcoin, Ethereum, Ripple, Tether, Bitcoin Cash, Litecoin, EOS, Tezos, Stellar Lumens, Cardano, Tron, Chainlink, USD Coin, Dash, Ethereum Classic, NEO, IOTA, Cosmos, NEM, ZCash, Basic Attention Token, Lisk, Agur, 0x, Waves, OmiseGo, Bitpanda Ecosystem Token, Komodo, Chiliz and Pantos.

As you can see, it’s a big list, which includes three of my favourite cryptos: Ethereum, IOTA and Tezos.

And if you join Bitpanda with this link, we’ll both get around £8.90 when you deposit and trade £23 or more.

Personally, I use all three of these exchanges, depending on how much of a hurry I’m in and which crypto I want to buy or sell.

Like most things, it’s not really a one-size-fits-all deal, which is why I’ve included all three in this guide.

I have also seen Wirex recommended by some people. But Wirex is more geared towards giving you a card to spend crypto with.

It’s also hard to work out what tits fees are. If you want to try, you can take a look at the Wirex fees page. As you’ll see, it’s not exactly easy.

And, as I’m sure you’ve found yourself, in many areas of life, when fees are made difficult to wrap your head around, you’re usually getting a bad deal.

Another purely bitcoin option is Coinfloor. It is based in the UK, which is great.

But it only caters to clients spending a LOT of money. And it has much higher fees than Coinbase or Bitpanda. So I have no idea why anyone would use it.

That is, unless you’re spending over £1 million per trade, in which case, its fees are the same as Binance Jersey. So if you’re a “whale”, it’s certainly one to consider.

No matter which exchange you use to buy bitcoin always follow the three golden rules of crypto trading

(If you’ve already read my why are crypto prices falling guide, you’ll have seen this next bit before. But I thought I’d add it on to this guide as well because a lot of people didn’t get chance to read it at the time.)

1. Never invest more than you are happy to lose

This is the single most important rule when it comes to crypto investing.

It doesn’t matter what you invest in, or how you invest in it, so long as you follow this rule.

The reasons for this are twofold:

1. It will keep you sane.

If you’re only ever putting money into crypto that you don’t need, money that you are perfectly willing to see go to zero, then you won’t be so stressed about the frequent ups and down of the market.

You’ll be free to live your life, without the constant need to check crypto prices, and the constant fear that you are losing money you actually need.

2. Strangely, it could mean you end up making more money.

Here’s the thing. Crypto is extremely volatile. That’s why it’s so fun to invest in. So a very small stake could make a significant difference to your life.

In the last crypto bull run, many people had the chance to make ten times their money or more, simply by investing in the biggest cryptos.

They also would have frequently seen their crypto investment drop by 50% or more in a matter of days.

But the chances are, they wouldn’t have seen that 10x gain if they hadn’t stayed in after that 50% loss.

Over the course of 2017, Ethereum dropped by 50% three times. It may have even happened more than three times. But I certainly remember those three.

However, by January 2018 it was way up.

If you’re only investing money you don’t care about, then you don’t mind seeing that money lose 50%, or even 90% of its value. So you can stay invested.

However, if you actually rely on that money, when it drops you will be forced to cash out… and then you’ll likely miss the 10x gain.

If a stock falls by 50% or more in a matter of days, it’s probably never going to recover. Or at the very least, it may take years, or even decades to do so.

In crypto, we see 50% drops followed by 200%+ gains all the time.

Or to put it another way, your maximum loss is capped by the amount you put in (unless you’re using leverage. Never use leverage in crypto, you maniac).

But your maximum gains are unlimited.

Say you put £150 into Ethereum. You can only ever lose £150. But you could potentially make thousands. £26,250 in the case of 2017.

But for the chance to make that £26,250, you have to be happy to watch your £150 go to zero.

I would be happy to watch a £150 investment go to zero. I wouldn’t be happy to watch a £10,000 investment go to zero.

Only you know how much money you’d be happy to lose in crypto. And you have to be happy about it, otherwise what’s the point of investing at all?

2. Dollar-cost average in and banish your emotions

Dollar-cost averaging (DCA) means investing a set amount at set intervals, no matter what the price of the asset is.

For example, you may decide to invest £50 into crypto on the third Thursday of every month.

You will do this whether crypto prices are up or down at the time.

By doing this, you’re not trying to time the market, and you’re taking your emotions out of the equation.

Every famous investor will tell you that you need to take your emotions out of investing if you want to succeed.

Over the long run DCAing means you end up buying more crypto when its cheap. So you bring down your entry price. Which means you make more profit when you sell.

If you weren’t DCAing you probably wouldn’t have ended up buying when prices were really low because your emotions would have taken over.

And you would have probably ended up buying more when prices were high because of the general market euphoria.

This strategy also allows you to ensure you’re not investing money you can’t afford to lose, as it will stop you just putting in a big lump sum when it looks like prices are about to rocket.

The importance of taking profits

You can use a similar, logical strategy when you cash out.

If you don’t take profits from time to time, you could end up with nothing to show for your efforts.

This realisation hit people hard during the crypto winter.

It was near-impossible not to make money in crypto over 2017.

True, there were many days of 50% drops or more.

But if you’d been invested at the beginning of the year, you’d likely be up more than 1,000% by January 2018.

However, if you didn’t take any profits along the way, there’s every chance you’re right back where you started today.

Of course, that’s easier said than done.

An easy way to overcome this issue is to simply set price targets and stick to them.

You could take out a certain percentage of your investment every time it goes up by 50% or more.

Or, you may want to do what a lot of investors do and take out your initial investment if it doubles.

That way you’re “playing with the house’s money”. All your gains from there on out are effectively free.

(So long as you don’t then get carried away and dump all that profit back in.)

It’s true that back in 2017, it was pretty hard to actually cash out. But today, we have many options, as you’ve just seen in this guide, which will let you cash out in minutes.

3. Don’t leave your crypto on an exchange: not your keys not your crypto

“Not your keys, not your coins.”

If you follow any crypto communities, you’ll have heard that phrase more than a few times.

What it means is if you store your crypto on an exchange – any exchange – you don’t really own your crypto at all, the exchange does.

If the exchange gets hacked, you’re the one that loses out.

And as you’re no doubt aware, exchange hacks happen ALL THE TIME in crypto.

There was literally one as I was writing this feature.

In 2019 alone, there have been seven major exchange hacks.

Even Binance, the biggest crypto exchange in the world, was hacked in May 2019. (Although it should be said that Binance ensured none of its users lost money because of the hack.)

A lot of the time, when an exchange is hacked, it is forced to shut down, and its users may never get any compensation. If the money isn’t there, the money isn’t there.

However, there is an easy way to make sure you won’t lose any money if an exchange is hacked. Don’t store your crypto on an exchange.

You should only ever move your money on to an exchange when you’re about to trade it.

Once you’re done with your trade, you should move it straight back on to your own hardware wallet.

What is a hardware wallet and why should you use one?

Hardware wallets are basically tiny encrypted computers designed for one purpose: storing crypto securely.

They are usually around the size of a USB stick, and you need to plug them into a computer or connect them to a mobile phone to use them.

The private keys to your crypto are stored, encrypted, inside the hardware wallet, and they are never revealed when you use them.

This means you can connect them to your computer or phone without worrying that hackers or malicious software will steal your crypto.

They also employ pin numbers, with increasing lockout times for wrong answers. So even if they do fall into the wrong hands, your crypto should remain safe.

Which means, in theory at least, hardware wallets are unhackable.

What if you lose your hardware wallet, will you lose all your crypto too?

No.

When you set up a hardware wallet, you have to write down a passphrase in order to make it work.

This passphrase is usually around 20 random words, and it can be used to recover your wallet if you ever lose or break it.

All you need to do is buy a new hardware wallet and re-enter this passphrase into the new wallet. Then your cryptos will magically appear.

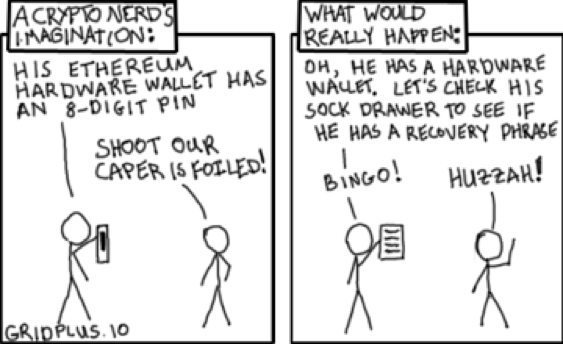

So it goes without saying, you need to keep that passphrase safe and secure. Otherwise you might fall victim to the “sock drawer” attack.

Source: gridplus.io

Source: gridplus.io

Which hardware wallet should you use?

There are two main hardware wallet makers on the market.

They are Trezor and Ledger.

Both their products are great. And I have used both of them.

Which one you decide to use, depends on which one supports your crypto.

You can see which cryptos each one supports here:

See which cryptos Trezor supports.

See which cryptos Ledger supports.

And if you’re going to buy one, I would suggest buying through their official sites, using the above links.

A hardware wallet is one of the few things you probably don’t want to buy through Amazon or eBay.

Get it straight from the manufacturer. They both have fast shipping worldwide.

Okay, that’s all for this week.

I hope you found this guide useful.

Thanks for reading.

Harry Hamburg

Editor, Coin Confidential

This article originally appeared on coinconfidential.com.